Published on Friday, 3 July 2020 at 10:57:57 AM

NOTICE OF INTENTION TO LEVY DIFFERENTIAL RATES 2020/2021

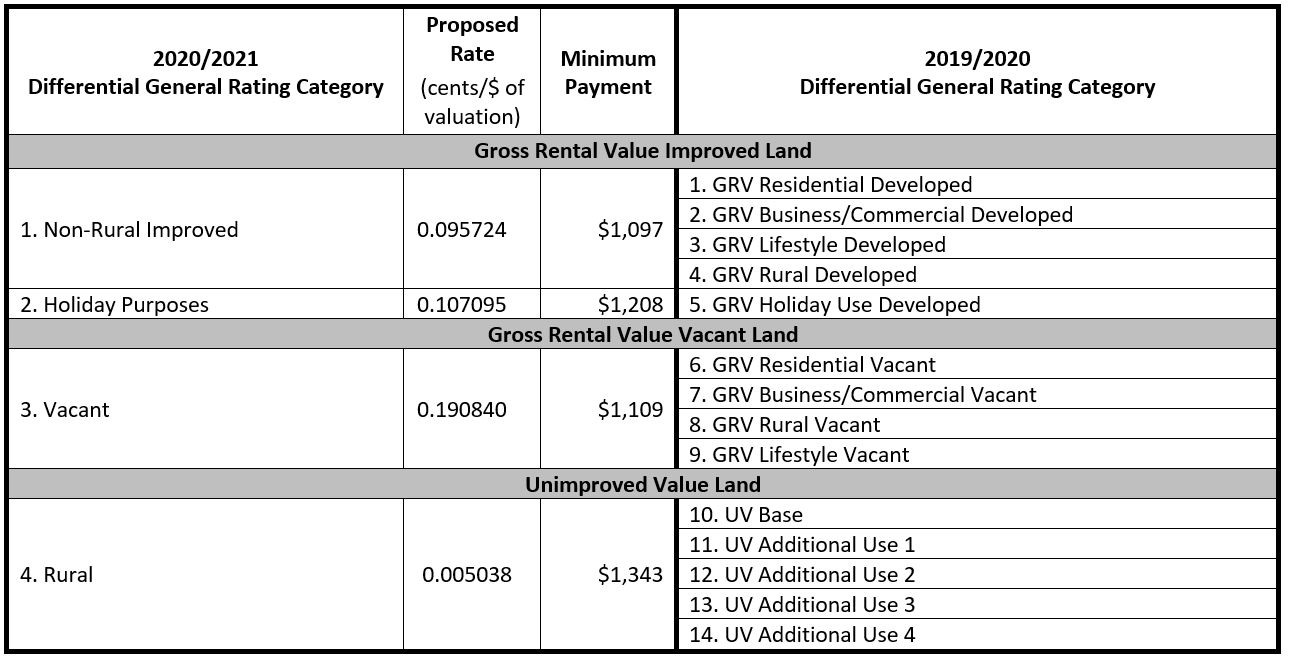

In accordance with Section 6.36 of the Local Government Act 1995, the Shire of Denmark hereby gives notice to ratepayers of its intention to impose differential rates for each rating category in the 2020/21 financial year. Details of the proposed rate charges are as follows:

Pursuant to section 6.36 (3A) of the Local Government Act (1995), the basis on which the Shire determines that a property is held or used is as follows:

- Non-Rural Purposes – a property is determined to be held or used for Non-Rural Purposes where the method of valuation used for the property for the purposes of rating is the Gross Rental Value (GRV) of the property.

- Holiday Purposes – a property is determined to be held or used for Holiday Purposes where the property is operating as a holiday home or holiday accommodation or where it has been granted planning approval by the Shire to operate as a holiday home or holiday accommodation and where the method of valuation is on a non-commercial basis.

- Rural – a property is determined to be held or used for Rural Purposes where the method of valuation used for the property for the purposes of rating is the Unimproved Value (UV) of the property.

Invitation to Provide a Submission to Council

The objects and reasons for each proposed rate and minimum payment may be inspected at any time. Visit www.denmark.wa.gov.au/differential-rating-in-the-shire-of-denmark.aspx to review the Statement of Objects and Reasons, or in person at the Shire of Denmark Administration Centre, 953 South Coast Highway, Denmark between 9am and 4pm Monday to Friday. The Shire invites submissions in relation to the differential rates on or before Friday 24 July 2020. All submissions are to be addressed to the Acting Chief Executive Officer, David Schober, and will be accepted by post, email or hand-delivered. For further information, please contact Rating Services on 08 9848 0301 or email rates@denmark.wa.gov.au.

Rates explained

Rates are an annual payment made by property owners to the Local Government. Rates pay for the delivery of vital community services and infrastructure, such as roads, footpaths, parks, libraries and recreation centres - to name just a few.

What are differential rates and how do they apply?

In simple terms, differential rates mean that there is a different rate for different types of property categories, such as vacant land, rural land and holiday accommodation. Different rates in the dollar are applied to each property type to ensure fairness and equity. To view the different rates in the dollar for 2020/2021, see the Notice of Intention to Levy Differential Rates.

How are rates calculated?

Rates are calculated by multiplying a rate in the dollar (set by Council) by your property valuation (determined by the Valuer General’s Office, an independent State Government organisation).

Council sets the rate in the dollar as part of each year’s budget process. It is based on the Shire’s expenditure requirements, both operating and capital, offset by other forms of income such as government grants and fees for services.

All properties are valued on either a Gross Rental Value (GRV) basis or Unimproved Value (UV) basis. GRV is an estimate of the rent a property could earn in a year. UV refers to what a parcel of land would be worth if sold.

Example

A residential property is valued at $15,000. That is, the Valuer General has determined that in one year, that property could earn $15,000 in rent.

The rate in the dollar set by Council for Non-Rural Improved (residential properties) is approx. 10 cents.

Rate in the dollar x valuation = total rate amount payable.

0.10 x $15000 = $1500 in rates.

Why have the number of rating categories reduced?

In 2019/2020 the Shire of Denmark undertook a major review of the existing rating structure in order to make the system simpler, fairer and more transparent. All ratepayers were contacted as part of the review, with the community providing feedback on reducing the number of categories from fourteen to four.

The new model is based on the premise that if the Valuer General determines Property X is worth more than Property Y, then Property X will pay more in rates regardless of whether the property is residential or commercial. Separate rating categories were created for vacant land (to encourage land owners to develop their land) and holiday purposes (to offset the additional costs and impacts of holiday home and Airbnb-style properties).

|

Will my rates go up?

No. Due to COVID-19 and the impact that it has had on the community, the Shire will ensure a 0% rate increase for ratepayers in 2020/21. However, a small number of property owners may see a difference on their rate notice from last year due to changes in their property’s value or type as a result of development work (for example completing the build of a house on a previously undeveloped block, or adding an extension or shed to a property).

|

Want to know more?

Further information on the Shire of Denmark’s rating system can be found on the website www.denmark.wa.gov.au/residents/rating-services.aspx.

David Schober

Acting Chief Executive Officer

Back to All News